József Varga[1] - Lívia Tálos[2]: The Analysis of the Turkish Participation Banks in the Period of 2007-2015 (JURA, 2017/1., 162-172. o.)

Introduction

The operation of the Islamic financial transactions and banking products is rooted in the Islamic religion within that in the Islamic law or Sharia; therefore, it can be difficult to understand for the Western world. Perhaps most well-known principle of Islamic finance is the prohibition of charging interest or riba (usury). Charging interest was illegal according to Islamic law and was rejected; i.e. it was not allowed to ask for interest on money loans. According to Islam, the money is just a simple instrument and it has no value by itself, it is merely used to measure the value of things. On the basis of this it is prohibited to produce money from money by funds rate. (Balázs, 2011)

In a former publication of Bajkó-Varga-Sárdi (2013) was made an analysis of the Islamic banking system based on the 'saver-bank-borrower' relationship. Within the Islamic banking system, the relationship among the financial institution, the saver, and the borrower is analyzed according to the following three aspects: the type of relationship, the risk taken by the participants, and their relation to profit maximization.

In case of the Islamic banking system, the use of money is not neutral for the saver. First of all, he has to be sure that the money does not finance any prohibited activity. Second, his return or loss depends on the success of the borrower. Therefore, in this construction all the three parties are in connection with each other, the financial institution does not constitute an impenetrable "wall" between the saver and the borrower: The borrower and the saver find each other by the bank's intermediation.

Within the Islamic banking system risk is a natural part of the business life, which equally applies to the participants of the transaction. Participants share the losses. Transactions with great risk have to be avoided. Moreover, speculative deals are explicitly forbidden by the principles. In Islamic banking system, transactions or contracts must be evaluated separately so as not to interfere with the laws of Sharia, and - as loss is shared anyway - it is much easier (cheaper) to say "no" at the beginning than quitting from a collapsed enterprise. Thus, the chance of giving loans to a bad debtor is relatively small. Even in case of returns lower than expected, penalty interest cannot be required due to religious reasons. In such a situation, the bank may account for some additional cost, but its main interest is to have its client to be solvent again. If it can be achieved only by reduced installments then the bank has to go with the modification. Actually, most Islamic banks can also be regarded as banks for the needy and poor. It may origin from the fact that Islamic economic system is clearly egalitarian. (Falus, 2015)

The conduct of the Islamic bank at this point is very similar to the basic concept of the Grameen Bank (Bank for the Poor) model. The bank for the poor has the opportunity to reschedule the installments without stressing the client with certain sanctions - contrary to the conventional banks where imposition of sanctions are expected. In such cases the bank for the poor helps its clients for recovering the lost money as soon as possible. (Bajkó-Varga-Sárdi, 2013)

Profit generation is a central mission for the Islamic banking system as well, the partner-based relationship among the participants, however, is also very important regarding it as real value (especially when all the three parties reach their goals). Because of the risk community they establish, they are all interested in the other one's success. Taking into account the fact that speculative, future or forward and other risky transactions are prohibited, the finance of productive sector comes into view, which gains lower yield at lower risk level.

According to András Kecskés' definition, corporate governance is the adequate governance system of companies which covers the relations between the management, owners, employees, and other concerned persons, which is based on the lawful, ethical, reasonable, efficient and socially useful solutions for profit-oriented operation, which is regulated by statutory provisions and the self-regulating mechanisms of the market and the business spehere. (Halász-Kecskés, 2013) As it was previously outlined, it is doubtless that the activi-

- 162/163 -

ties of Islam banks are compliant with ethical and social utility. In the case of Islam banks, a key difference in governance principles is that most of the relevant rules are rooted in Islam, rather than in laws created by governments or by the self-regulatory activities of the business sphere.

Another issue regarding governance would be the interests to be observed by the management. (Kecskés, 2008) Traditionally there are two approaches to this question, the first one prioritisies shareholders, whereas the second approach stipulates that all the interests of all the stakeholders ought to be observed. (Kecskés, 2010). Stakeholders are those persons who are affected by the activities of a corporation. (Kecskés et al., 2011) This includes a wide range of persons, from shareholders and management to employees and even business partners (Kecskés, 2010). One critical aspect regarding management is their remuneration, which is still the source of many debates, especially in light of the events of the 2007-2009 financial crises. (Kecskés, 2015; Kecskés-Halász, 2010).

It it worth comparing Islam banks and conventional banks from a corporate governance viewpoint, as it offers valuable insight to the key differences between the two banking systems; also showcases the benefits of lending policies based on the teachings of Islam. As banks prepare for the impact of Basel III regulations, many Islamic financial institutions are finding they already exceed the requirements (Széles, 2015).

1. Islamic banking system and the 2008 economic crisis

After the outbreak of the crisis the interest-free banks got into the centre of attention which operates according to Islamic principles. These banks did not have such "toxic" assets as traditional banks, their loans were not converted into securities, and did not undertake high-risk commercial transactions, nor did they speculate. (TKBB Annual Report, 2009) According to Lentner (2015) the conventional banks' over-lending activity, higher profit goals and the globalization of the management techniques led largely to the 2008 economic crisis.

As soon as the attention was focused on interest-free banking, or, as the world calls it, Islamic banks, several conventional banks have started to open such departments. (TKBB Annual Report, 2009) These sections are called 'Islamic windows'. Following the 2008 crisis the demand for Islamic financial products increased, and conventional banks took advantage of this trend and started to open Islamic departments. These windows operate completely according to Islamic principles. (Gálosi, 2010)

Since the outbreak of the 2008 economic crisis the issue of the stability of the banking system has become increasingly important. The attention has turned from traditional financing strategies to alternative financing forms, and the banks operating on Islamic religious principles have been given a greater role, since they were hit less harder by the crisis than conventional banks. (Varga, 2011) The stability of the Islamic banks was higher than the stability of the conventional banks during the crisis, that is why the Islamic bank sector tries to expand its market share not only in Islamic countries but in Christian countries too. (Pavelka, 2016)

The integration under the Basel III directive does not spare all the antecedents since Saria has been already introduced as a source of law, the socalled Saria judiciariaries were inducted (Islamic Sharia Council) in Great Britain. This was a result of the fact that the archbishop of Canterbury saw the tendency clearly in 2008 that Europe is aging, the demografic balance leans toward the Muslims, therefore the question is relevant: Is it possible to integrate Islam into the European democracies' structure? Another question is whether it is possible to integrate Islamic banks under Basel III?

Within a few years the Saria judiciariaries got official legitimation during business related and financial legal conflicts. Hence the legal application of subculture was controlled by the state, the main conflicts ended. Due to Islamic financed products expanding in Germany it is necessary to ensure pioneers as the background of legal material of Saria (Cseh, 2014).

2. Camel analysis

Turkey's banking system consists of 49 banks, four of them operate according to the Islamic principles, and they called Participation banks. Albaraka Turk Participation Bank Inc. was founded in 1985. Asya Participation Bank Inc. is the youngest, as it was founded on 24th of October in 1996. Kuveyt Turk Participation Bank Inc. founded in 1989, deals with interest-free financing. Turkiye Finance Participation Bank Inc. was formed on 3rd of October in 1991. (TKBB Annual Report, 2013) Here we would like to mention that the fifth Islamic bank Turkish Ziraat Participation Bank was also founded on 14th of October in 2015. (www.ziraatkatilim.com.tr)

In our former research (Varga-Tálos, 2016) we analysed the Turkish Participation banks' reports

- 163/164 -

between 2007 and 2013, then in this article in the final section we analyzed more data between 2014 and 2015. The Turkish Participation banks prepare their annual report according to International Financial Reporting Standards (IFRS) so that they are investigable, internationally comparable. The data for the analysis came from the unconsolidated financial statements. For the test we used data from the Participation banks' annual reports in English and in Turkish language between 2007 and 2015, which are available for downloading from their websites on the Internet. On the basis of five criteria 3 indicators per criterion were calculated and evaluated. The results of the four banks were averaged separately, then classified according to the desired criteria, the changes over the years and the relative values of the four banks.

We use CAMEL method, that gives comprehensive view about Capital adequacy, Asset quality, the Management, Earnings and about Liquidity. The CAMEL method is a subjective grading method, but in this case we use it with the objective of presenting the evolution of the performance of the banks.

The selection of the best indicators of banking activities can be difficult. The CAMEL analysis is considered to be the most appropriate method. The CAMEL method was introduced in 1979 by the US banking supervisors.

On the basis of this method the analysis of the banks is done in two steps. In the first step the individual factors are graded on a scale of 5 points:

1 = good

2 = sufficient

3 = satisfactory

4 = acceptable

5 = inadequate.

The next step is the overall classification of financial institutions also on a 5-point scale as an average of the previous ratings:

1 = financially strong

2 = basically good, few problems

3 = major problems exist

4 = deteriorated financial situation

5 = high probability of bankruptcy.

(Baka, et. al, 2012)

2.1 Capital adequacy (C)

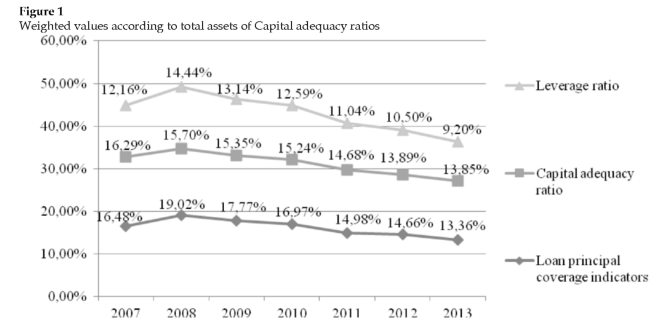

The main task of the Capital adequacy ratio (CAR) is maintaining the bank's long-term solvency. The indicator expressing solvency is used worldwide. The value of the index should be at least 8% in accordance with Basel standards. The data show that in the examined years all banks met the 8% criteria morever, they reached even higher than that. Looking at the averages, Turkiye Bank had the highest Capital adequacy ratio in the examined years, but the other banks' results were also close to this value. As each bank's results were above the desired value, we regard the development of Capital adequacy ratios as good.

The Leverage ratio also provides information about the bank's prudence, namely the distribution of equity and debt. The results of the index were calculated by the comperison of the equity and total assets of the banks. If the ratio of foreign funds were too high, it would mean that the Turkish Participation banks pursue risky activities. The reductions of the indicators suggest that the equity ratio increased. Banks mostly manage foreign resources so a high leverage is typical. In this case, following the crisis the change was a decline, i.e. we can talk about careful business, which, however, in turn could lead to a deterioration of profitability.

Table 1

Results of the Capital adequacy indicators

| Bank | Capital adequacy ratio | Leverage ratio | Loan principal coverage indicators | |||

| Average | Mark | Average | Mark | Average | Mark | |

| Albaraka | 15.55% | 1 | 11.01% | 2 | 15.05% | 3 |

| Asya | 13.89% | 1 | 13.07% | 1 | 17.74% | 2 |

| Kuveyt | 15.17% | 1 | 10.57% | 2 | 15.01% | 3 |

| Turkiye | 15.80% | 1 | 12.21% | 2 | 16.05% | 3 |

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

- 164/165 -

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

The main activity of the banks is lending. It is important to monitor the degree of credit losses througout this activity, i.e. how they are capable to cover the losses. This is shown by Loan principal coverage indicators. The values of the indicators show varying trends from year to year, but drastic changes cannot be detected. The decreasing tendency can be explained by the growth of loans.

At the end of each of the five factor test we calculated average for the Turkish Participation banking system by weighting according to the balance sheet total (Figure 1).

The Turkish Participation banking sector's capital adequacy is stable, its Capital adequacy indicators were in line with the accepted value and its solvency was not threatened.

2.2 Quality of Assets (A)

Lending activitie are especially important for banks, so it is essential to analyse the quality of the assets in terms of the bank's successful operation and efficiency.

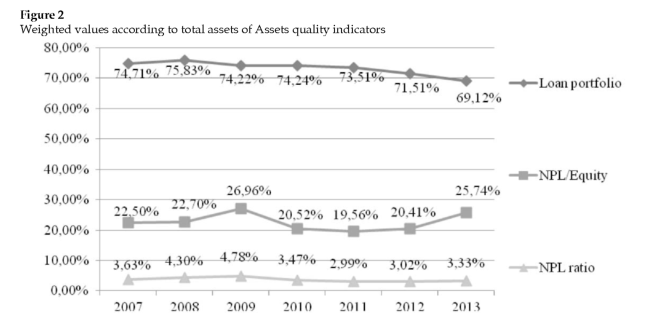

The NPL ratio provides information about the level of Non-performing loans in the total loan portfolio. In the crisis a significant jump in the Non-performing loans was typical. However, he value of Non-performing loans below 5% is acceptable. Between 2008-2009, during the crisis there was a slight increase in the proportion of Non-performing loans for all four banks and the values of Kuveyt and Asya jumped above the accepted value. From 2010 to 2012, there may have been adverse events in the operation of Bank Asya, whereas the number of non-performing loans portfolio increased significantly.

From the comparison of the extent of the NPL to the equity it can be seen that all four banks' indicators increased in the period starting from 2008 as a result of increased Non-performing loans portfolio. Bank Asya values have been higher than those of the other three Turkish banks since 2010 and its value has increased significantly since 2012.

Table 2

Results of the Assets quality indicators

| Bank | NPL ratio | NPL ratio to equity | The ratio of total assets in the loan portfolio | |||

| Average | Mark | Average | Mark | Average | Mark | |

| Albaraka | 2.62% | 1 | 17.89% | 2 | 72.97% | 1 |

| Asya | 4.96% | 2 | 29.00% | 4 | 73.83% | 1 |

| Kuveyt | 3.67% | 1 | 24.21% | 3 | 70.36% | 1 |

| Turkiye | 2.89% | 1 | 17.96% | 2 | 76.05% | 1 |

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

- 165/166 -

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

The banks' activity is dominated by lending with more than 70%. On the positive side, all of the banks' loan portfolio was higher year after year; i.e. their lending activity has not slowed down. However, we can approach this also from the perspective that a high loan portfolio can be risky, so considering safety i.e. because of the risk of return a high loan portfolio can be negative. However, in the case of banks, lending means a greater profitability than investments for example.

With respect to assets we can say that the ratio of Non-performing loans is low and there is no significant deterioration, in spite of the fact that there were unfavorable economic conditions in this period .

2.3 Management efficiency (M)

The bank's management is mainly examined with cost efficiency indicators. The revenue and the cost of the Turkish Participation banks were obtained from income statement of annual reports. Revenues consist of Profit from loans, Profits from the "movable assets", from the Sale and from Leasing of financial income. Naturally, interest and similar income are not found in Islamic banks' revenues. The total cost of the Turkish Participation banks consists of Expenditures and Other spending items, in which a steady increase was registered during the reference years.

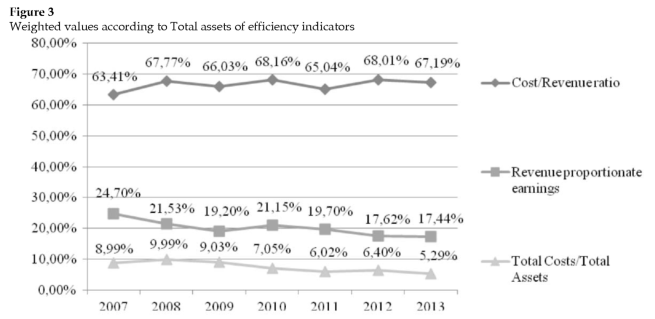

The higher the Cost/Revenue index is the less efficiently a bank operates, i.e. costs erode larger and larger parts of the revenue. The improvement in the cost-effectiveness can be discovered in some places, but it is not significant. Costs consume more than 60% of the revenues. Comparing the four banks, Turkiye proved to be the least cost-effective.

The following is Revenue proportionate earnings. The pre-tax profit and total revenue ratio reflects the operational efficiency, namely how much of the proceeds is made up by the profits. It is clear that the index value fell between 2008 and 2009, but since 2009 the Turkish banks have been improving except Asya.

Table 3

Results of the Management efficiency indicators

| Bank | Cost / Revenue ratio | Revenue proportionate earnings | Total Costs / Total Assets | |||

| Average | Mark | Average | Mark | Average | Mark | |

| Albaraka | 64.07% | 3 | 22.25% | 1 | 6.83% | 2 |

| Asya | 67.69% | 3 | 17.92% | 3 | 8.56% | 3 |

| Kuveyt | 65.30% | 3 | 19.61% | 2 | 6.69% | 2 |

| Turkiye | 68.14% | 3 | 21.68% | 1 | 7.58% | 2 |

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

- 166/167 -

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

We can examine the developments on Assets proportionate costs. The index takes into account all costs showing the costs of financial intermediation. The costs of financial intermediation increased in 2008. The proportion of costs compared to total assets is high, but it is positive that we can see a downward trend in the years following the crisis and after 2012. Earlier we saw Turkish banks' leverage ratio declining, which is likely to have a negative effect on the profitability, pushed it down.

The efficiency of the banks showed a slight declining performance due to adverse changes in the costs, which have risen at the expense of profits. Overall, the examination of the Turkish Participation banking performance indicators showed no dramatic changes.

2.4 Earnings (E)

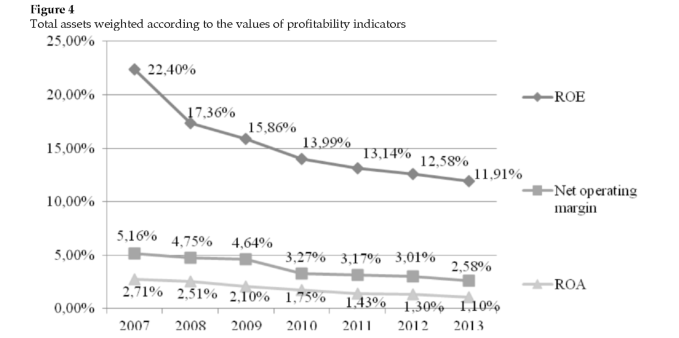

By using the profitability indicators we can gain infromation about the effectiveness of management, i.e. how effectively the available funds and the assets acquired from them are used to generate profits. As we mentioned, we cannot find interest and similar income in the Islamic banks' profit, but nonetheless they are managed effectively. Return on Equity (ROE) and Return on Assets (ROA) are the commonly used indicators of profitability.

ROE answers how the equity produces profit. In case of banks a healthy ROE is around 10-12%. This indicator did not depict a negative value, because there was not negative profit after tax. Markedly the profitability of the Bank Asya decreased significantly and steadily from 2009, which can be explained by the decrease of net result. The other banks, however, performed above the expected value.

The ROA gives us data about banks'assets. It shows how the good placements of banks and the effectiveness of banks' placements are. The value of the index between 1 and 2 is estimated to be good. The decline of the indexes reflects the deterioration in the banks' recovery. From 2009 a downward trend can be observed. The downward trend in ROA is typical, but it is still within the limits.

We get a picture about the effectiveness also by

Table 4

Results of the Earnings indicators

| Bank | ROE | ROA | Net operating margin | |||

| Average | Mark | Average | Mark | Average | Mark | |

| Albaraka | 16.56% | 1 | 1.84% | 1 | 3.91% | 2 |

| Asya | 14.27% | 2 | 1.97% | 2 | 4.18% | 2 |

| Kuveyt | 14.88% | 1 | 1.57% | 1 | 3.50% | 3 |

| Turkiye | 15.82% | 1 | 1.91% | 1 | 3.50% | 3 |

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

- 167/168 -

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

calculating Net operating margin. After the deduction of the full cost of total revenue is compared to total assets. After of the calculation of the index we have got a varied picture. Since 2008 Asya has been working with decreasing effectiveness, but Albaraka and Turkiye could improve the effectiveness.

Earlier we saw that the Turkish banks' Leverage ratio was in decline, which is likely to have had a negative effect on the profitability and have spoiled it.

2.5 Liqudity (L)

The Liquidity indicator shows how fast the banks' financial instruments can be converted to cash without losses. The liquidity indicator informs you to what extent it can meet its short term liabilities with short term assets. The higher the index value is the more liquid a bank can be considered. Of course, liquid assets mean lower returns than illiquid assets, so it is important to choose the right assets. Liquid assets include Cash and deposit accounts at the Central Bank, Interbank deposits, as well as the Financial assets for sale. Cash and deposit accounts at the Central Bank are the bulk of the Turkish banks' liquid assets.

We get a fluctuating picture of the changes of the liquidity of individual banks. The increase and decrease in liquidity may be justified by the changes of banks' liquid assets. In the case of Participation banks the increase in liquidity can be explained by the rise in Cash and Central Bank accounts.

The Turkish Participation banking system is on the rise in collecting deposits. The tested banks collected more and more funds each year.

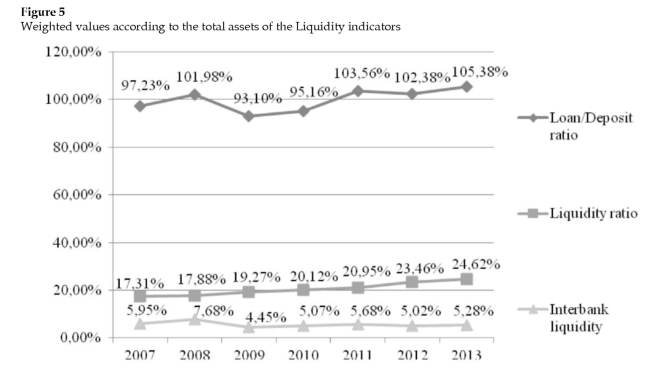

The Banks' business policy indicated by the Loan / Deposit ratio. In the years between 2011-2013 and in 2008 the index was 100% (Figure 5) that is above the healthy limit, which meant that the Participation banks were on aggressive business policies, that is the size of the loans exceeded the value

Table 5

Results of the Liqudity indicators

| Bank | Liquidity ratios | Credit / Deposit ratio | Interbank liquidity | |||

| Average | Mark | Average | Mark | Average | Mark | |

| Albaraka | 20.53% | 1 | 92.03% | 1 | 10.05% | 2 |

| Asya | 18.87% | 2 | 100.67% | 1 | 2.15% | 4 |

| Kuveyt | 23.82% | 1 | 98.66% | 1 | 8.60% | 3 |

| Turkiye | 19.06% | 2 | 105.98% | 2 | 3.72% | 4 |

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

- 168/169 -

Source: Edited from annual reports of the Turkish Participation banks, 2007-2013

of deposits, which has been a liquidity risk. It may also be an important consideration what the composition of deposits is like, because, if they have a lot of low-value, short-term deposits, instead of the large deposits, the sudden withdraw of the deposits can also cause disturbances in the operation of the banks.

In order to get a picture of Participation banks in the interbank position, Interbank liquidity ratios were calculated. At the majority of the Turkish banks the interbank deposit shows a changing trend. Based on the results they are likely to believe that customer deposits occur at faster than bank deposits.

It is clear that the liquidity ratio increased slightly, but the Loan / Deposit ratio was variable, but also slightly.

After individually rating Turkish Participation banks, we calculated average values for not only the banks but for the five assessment area as well (Table 6). The end result, according to the results of the banking system is 1.90, that is rounded to 2, that is good, which means that basically it is a good banking system, there are just few problems.

3. Results in 2014 and in 2015

In this section we briefly analyze the Turkish Participation banks' main indicators in the year of 2014 and in the first half of 2015 (Table 7).

The Turkish Participation banking sector's Capital adequacy indicators were in line with the accepted value in 2014 and in 2015, too; all banks met the 8% criteria. During the period of 2015, the Turkish banks' indicators fell slightly due to the increase in troubled assets, but they could keep their solvency.

There may have been adverse events in the operation of Bank Asya, as the proportion of Non-performing loans increased significantly. In 2014,

Table 6

Results of the Turkish banks CAMEL analysis

| Bank | C | A | M | E | L | Average |

| Albaraka | 2.00 | 1.33 | 2.00 | 1.33 | 1.33 | 1.60 |

| Asya | 1.33 | 2.33 | 3.00 | 1.67 | 2.33 | 2.20 |

| Kuveyt | 2.00 | 1.67 | 2.33 | 1.67 | 1.67 | 1.87 |

| Turkiye | 2.00 | 1.33 | 2.00 | 1.67 | 2.67 | 1.93 |

| Average | 1.83 | 1.67 | 2.33 | 1.67 | 2.00 | 1.90 |

Source: Based on the calculation

- 169/170 -

Table 7

| 2014 | 2015 | |||||||

| Indicator | Albaraka | Asya | Kuveyt | Turkiye | Albaraka | Asya | Kuveyt | Turkiye |

| CAR | 14.02% | 18.29% | 15.09% | 12.47% | 12.77% | 15.98% | 14.23% | 13.51% |

| NPL | 2.11% | 19.70% | 2.34% | 2.59% | 2.52% | 28.35% | 1.71% | 4.63% |

| Ratio of total assets in the loan portfolio | 67.14% | 66.23% | 60.50% | 69.46% | 62.78% | 75.45% | 61.47% | 70.03% |

| ROE | 14.11% | -47.70% | 12.25% | 10.60% | 14.40% | -9.02% | 13.07% | 7.78% |

| ROA | 1.10% | -5.95% | 1.09% | 1.01% | 1.02% | -1.18% | 1.06% | 0.68% |

| Liquidity indi- cator | 23.59% | 23.28% | 33.69% | 23.21% | 28.55% | 23.95% | 32.06% | 20.43% |

| Credit/Deposit ratio | 92.98% | 101.94% | 92.91% | 120.63% | 91.21% | 120.80% | 91.92% | 121.81% |

Source: Edited from annual reports of the Turkish Participation banks, 2014-2015

the proportion of NPL to total loan portfolio was 19.70% in the case of Bank Asya, in 2015 it was 28,35% which could be attributed to the negative conditions in the consumer loans and credit card business sector. We have to mentation that since 2008 Asya has been working with decreasing effectiveness.

The banks' activity is dominated by lending in 2014 and in 2015, too, but earlier we saw that the profitability decreased significantly and steadily from 2009, which can be explained with the decrease of the net result, and since 2013 it has had negative profit after tax. This resulted in negative ROE and ROA indicators. A negative result can be explained by the fact that due to the high rate of Non-performing loans provision had to be made, which worsened the outcome. If the ROE is too low, it can also pose risks, since in this case there is a danger that the growth will be marred by another source involved in the operation the case of Bank Asya we saw a gradual decline, and in 2014 Bank Asya closed with negative results.

We previously determied in the case of the Turkish Participation banks the increase in liquidity can be explained by the rise in Cash and Central Bank accounts, and the examined banks collected more and more funds each year. Overall, we can say that the Turkish banks have sufficient liquidity in 2014 and in 2015, too. In the tested years the Deposit/Credit index of Bank Asya and Turkiye was over 100% that is above the healthy limit, that is the size of the loans exceeded the value of deposits, which has been a liquidity risk.

4. Summary

In most countries the 2008 economic crisis appeared as a banking crises and after the crisis special attention was given to alternative financing techniques, and so to Islamic banks.

Due to the operational principles of the Islamic banks, as they do not take high risks, so their operation is not exposed to large losses, at the same time no huge profit is available for them, either. They emphasize partnership, i.e. it is important to consider each transaction from the perspectives of all three participants: the saver, the investor and the bank. Whether the transaction brings profit or loss the three participants share it. This operating principle is important as it may be relevant for anyone who comes in contact with a bank to monitor their savings because thereby they "can force" banks for safer investments and increase competition between them.

Turkey's banking system consists of 49 banks, four of them operate according to the Islamic principles. Using the annual reports of the banks in the period between 2007 and 2013, then in 2014 and in 2015, we evaluated the Turkish Participation banks individually and the Turkish Participation banking system as a whole by indicators based on of Capital adequacy, Asset quality, the Management efficiency, Profitability, and Liquidity. With this CAMEL analysis our primary goal was to get a picture of the operation of the Turkish Participation banks, the developments of their performances in the examined years.

In the case of the Turkish Participation banking sector the following conclusions can be made after examination of the data. On the basis of the calcu-

- 170/171 -

lated indicators we can say the business of the banks is not endangered. Bank Asya can be considered the weakest among the four banks according to its results. Furthermore, the Turkish Participation banks performance moved together in most cases. The stability of the banks' was not at risk, Capital adequacy is satisfactory. The quality of assets is also said to be satisfactory. There was not significant increase in bad loans; the banks' assets are classified continuously. With respect the management - which is quite difficult to measure -revenue, expenses, assets and earnings indicators express the relationship. In this area improvement is needed as quite high costs arise during operation. The biggest negative trend appeared in the downward tendency of profitability. The crisis and the changed economic environment were reflected in their performances but did not cause any drastic changes. The liquidity can be said appropriate, as banks sought to have sufficient amount of liquid assets.

Because of Islamic religious principles, they run not only safer business, but several financing activities common conventional banks are forbidden for them, that might violate their religion. Among them there are some activities which might took part in causing the crisis, like speculative transactions, or entering transactions with the aforementioned high-risk investments, and certain financial market techniques such as securitization. So the "bad" assets did not infect them. The crisis and the changed economic environment were reflected in their performances but did not cause any drastic changes.

References

Bajkó, A., Varga, J., Sárdi G. (2013): Rise of the Islamic Banking Sector In: Szendrő, K., Soós, M. (eds.) Proceedings of the 4[th] International Conference of Economic Sciences. 302-312.

Baka, I., Dancsó, J., Ligeti, S. Szarvas, F., Vágyi, F., Varga, J. (2012): Bankismeretek (in Hung.), Budapest: Tanszék Pénzügyi és Szolgáltató Kft., textbook, 44-62. p.

Balázs, J., (2011.): Az iszlám bankrendszer: Tanulságok a neoliberális pénzügypolitika figyelmébe (In Hung.) Valóság Vol. 54. No. 1. pp. 1-11

Cseh, B. (2014): A tradicionális vallási jog és a kodifikált állami jog együttélése. Az iszlám és a germán jogi kultúra a német területeken élő muszlim közösségekben (in Hung.), In: Drinóczi, T., Naszladi, G., Novák, B. (eds.) Studia Iuvenum Iurisperitorum 7. A Pécsi Tudományegyetem Állam- és Jogtudományi Kara Hallgatóinak Tanulmányai, 15-33. p.

Gálosi, M. B., (2010.): Iszlámablak - ablak az iszlámra (in Hung.), dissertation, Budapest Corvinus University

Falus O.(2015): Collaborative finance in a muslim way: WAQF In: Katalin Szendrő, Viktória Szente, Róbert Barna (szerk.) Proceedings of the 5th International Conference of Economic Sciences and 5th Climate Change, Economic Development, Environment and People Conference of the Alliance of

Central-Eastern European Universities. Konferencia helye, ideje: Kaposvár, Magyarország, 2015.05.07-2015.05.08. Kaposvár: Kaposvári Egyetem Gazdaságtudományi Kar, 2015. pp. 7381.

Halász, V., Kecskés, A. (2013.): Stock Corporations - A Guide to Initial Public Offerings, Corporate Governance and Hostile Takeovers. Budapest-Wien, HVG-ORAC - LexisNexis, p. 566.

Kecskés, A. (2010.): The Legal Theory of Stakeholder Protection. In: JURA. No. 1. pp 67-76.

Kecskés, A. (2008): Részvényárak mindenek felett? Érdekszférák a vállalatirányítás jogában. (in Hung.) In Kiss György, Bankó Zoltán, Berke Gyula, Kajtár Edit (szerk.) Emlékkönyv Román László születésének 80. évfordulójára. Pécs: PTE Állam- és Jogtudományi Kar, pp. 215-234.

Kecskés, A., Halász, V. (2010.): A siker díja vagy a bukás ára? A vállalati vezetők javadalmazásának elmélete a pénzügyi válság tükrében. (in Hung.) Jogtudományi Közlöny No.4., pp. 180-191

Kecskés, A. (2015.): "Say on pay" - Részvényesi szavazás a vállalati vezetők javadalmazásáról az Egyesült Államokban. (in Hung.) Jura No.1., pp 59-64.

Kecskés, A., Budai, J., Hanák, A., Hardi, P., Kazár, P. (2011.): Felelős vállalatirányítási és üzleti etikai szótár / Glossary of Corporate Governance and Business Integrity Terms. Budapest: The American Chamber of Commerce in Hungary, p. 44.

Lentner, Cs. (2015): A túlhitelezés globalizálódása a világban és Magyarországon (in Hung.), A Devizahitelezés nagy kézikönyve, Budapest, Nemzeti Közszolgálati és Tankönykiadó Zrt., pp. 23-62.

Széles, Zs. (2015): Accounting directives in the Islamic Banking System. Selye e-studies 6:(1) pp. 153-170.

Pavelka, V. (2016): A török iszlám és a hagyományos bankrendszer összehasonlító elemzése (in Hung.), dissertation, Kaposvár University

Varga, J. (2011.): Az iszlám bankrendszer szerepe a pénzügyi stabilitás helyreállításában (in Hung.) A Virtuális Intézet Közép-Európa kutatására közleményei 4: (1 (No.7)) pp. 121-132.

Varga, J.-Tálos, L.(2016.): The empirical analysis of the impact of the economic crisis on Turkish Islamic banks using CAMEL method, Regional and Business Studies, Vol. 8 No. 1. pp. 77-87.

Turkish Ziraat Participation Bank: http://www.ziraatkatilim.com.tr/en/our-bank/Pages/aboutus.aspx

Online Annual Reports of the Turkish Participation banks

Annual reports of Bank Albaraka.

http://www.albarakaturk.com.tr/faaliyet-raporlari.aspx

Downloaded: 2015.08.25.

www.albaraka.com/default.asp?action=article&id=55

Downloaded: 2017.01.20.

Annual reports of Bank Asya

http://www.bankasya.com.tr/en/investor-relations-annual-reports.aspx

Downloaded: 2015.08.25.

www.bankasya.com.tr/en/investor-relations-auditors-statements.2015.aspx

Downloaded: 2017.01.20.

- 171/172 -

Annual reports of Bank Kuveyt

http://www.kuveytturk.com.tr/financial_information.aspx http://www.kuveytturk.com.tr/finansal_bilgiler_hakkimizda.aspx

www.kuveytturk.com.tr/financial-information.aspx

Downloaded: 2017.01.25.

Annual reports of Bank Turkiye

http://www.turkiyefinans.com.tr/tr-tr/yatirimci-iliskileri/finansal-raporlar/Sayfalar/bagimsiz-denetim-raporlari.aspx Downloaded: 2015.08.25.

Annual reports of Participation Banks Association of Turkey:

http://www.tkbb.org.tr/research-and-publications-tkbb-publications-annual-sector-reports

Downloaded: 2015.10.30.

Downloaded: 2017.01.20. ■

Lábjegyzetek:

[1] The Author is associate professor, vice dean of science Kaposvár, University, Faculty of Economic Science.

[2] The Author is Hungarian State Treasury.